Blog | Integrated reports: a tool for change and evolution

Integrated reports are here to stay, and they represent an improvement in corporate responsibility, its management, transparency, an increase of reliability, and greater use of information and technology. But, what are they?

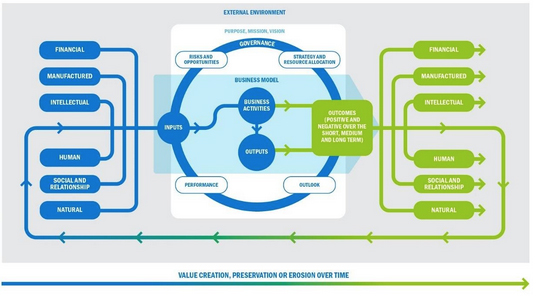

Well, let's start by saying that they are the evolution of corporate reports. They integrate quantitative and qualitative information, communicate the strategy, governance, performance, and the vision of an organization, taking into account its external context. It is a tool that leads to a clear appreciation of the creation of value over time.

Corporate evolution is one of the responses to the change in the structure to inform and communicate companies' achievements, challenges, future goals, and megatrends. Reporting and integrated thinking are correlated features that have resulted in a more efficient practice of communicating and allow adding relevant aspects such as risk and subsequent development, which satisfies a higher level of understanding by the interested parties.

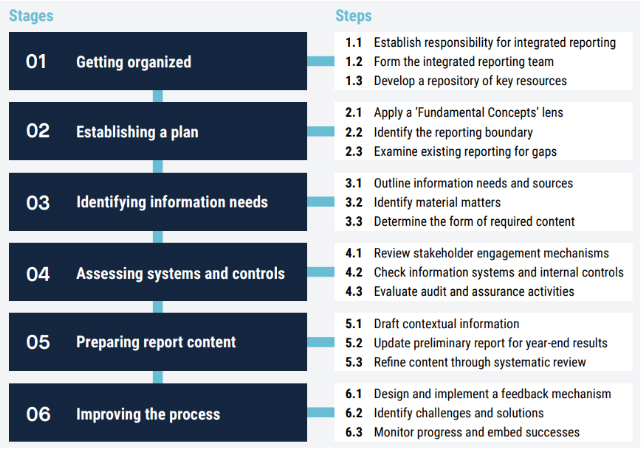

A preparation guide to migrate to integrated reports is: the International

To continue creating value through integrated reports and thus obtain practical results, the following basic aspects must be considered:

Additionally, and as part of the qualitative and quantitative information, the

Source: